Revenue with the occupation is obtainable in a decreased price than 50% of your gross receipts (i.e., the fees to be claimed is greater than fifty% of your gross receipts) and the entire income is over The fundamental exemption.

Are unable to get on your own started out on taxes? Have a Cleartax expert to manage all of your tax filing start-to-complete Get Cleartax skills now

? Leveraging the newest in lending tech, the chance of getting you a lender is : 0% We may well already have your file

Regardless of choosing presumptive scheme underneath part 44ADA, taxpayer can declare segment 80 tax preserving deductions and investments.

With one, simple kind, you may accessibility a network of lenders offering more possibilities to fulfill your preferences. Complete the shape in minutes from the ease and comfort of your own home, and if authorized, get pleasure from following-working day immediate deposit right into your account.

No, It's not compulsory to opt Portion 44AE, it is actually optional, if you choose for ordinary provisions, Then you definately might require to take care of guides of accounts and acquire exactly the same audited.

Complete supply chain Option for ultimate Command, effortless collaboration, and confident compliance

Section 44AD – As per Area 44AD, in which a taxpayer opts for presumptive taxation scheme for any with the money yr he is required to continue to decide for a similar for following five several years. If he fails to take action, he will not be suitable to go with presumptive taxation plan u/s 44AD for 5 years succeeding the 12 months where he opts out. Additional, with regard to Individuals five financial several years the place taxpayer is ineligible to choose presumptive taxation scheme u/s 44AD, frequent textbooks of account should be managed and audit shall be conducted if whole money exceeds simple exemption Restrict.

Subscribers will be able to begin to see the listing of final results connected to your doc throughout the subject areas and citations Vincent identified. You can sign up for a trial and take advantage of of our support such as these Positive aspects.

Related finance ecosystem for approach automation, higher Command, bigger financial savings and productiveness

When approved by a lender, your funds are deposited specifically into your account as soon as the following company day. We are below for yourself

To the face of it, shifting focus to distributions to compensated-in money around interior costs of return is bewildering presented how inadequately the sector website is performing on both equally.

The assertion is produced Each individual fork out period of time and is on the market to the worker through EPP and can be mailed less than Particular situations. It is available on the Company through RPCT Reporting Middle.

The Restrict is elevated to INR seventy five lakhs if the entire total obtained in cash won't exceed five per cent of the total gross receipts of such preceding calendar year.

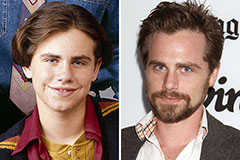

Rider Strong Then & Now!

Rider Strong Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!